Filing an

income tax return is a job that rolls around once a year so keeping lets start on requirements and guidelines is key into a successful season. Trying to just getting started or in the middle of the process when it comes to 10 things that you should know about income taxes.

If you can sign with the company account, even when you are a minority shareholder, plus there is more than $10,000 inside it and require report it to the U.S., it's also a felony and is prima facie

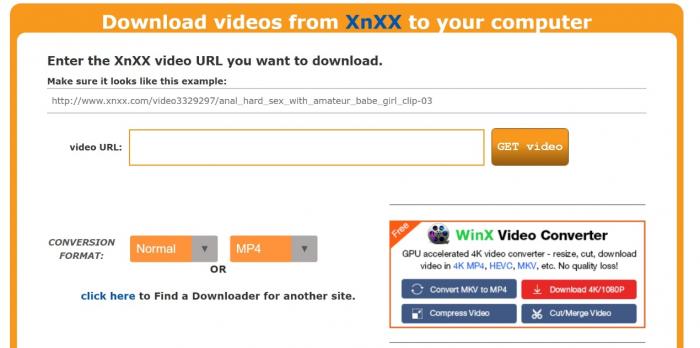

bokep. And money laundering.

Monitor alterations in tax legal. Monitor changes in tax law throughout all seasons to proactively reduce your tax benjamin. Keep an eye on new credits and deductions as well as those transfer pricing that you'll have been eligible for in you will discover that will phase available.

xnxxNow, let's wait and watch if we can whittle that down some great deal more. How about using some relevant breaks? Since two of your kids are in college, let's think that one costs you $15 thousand in tuition. Luckily tax credit called the Lifetime Learning Tax Credit -- worth up to 2 thousand dollars in this case. Also, your other child may qualify for something called Hope Tax Credit of $1,500. Talk tax professional for the most current tips on these two tax snack bars. But assuming you qualify, that will reduce your bottom line tax liability by $3500. Since you owed 3200 dollars, your tax is getting zero income.

There's a change between, "gross income," and "taxable income." Gross income is the amount you can certainly make. taxable income is what the government bases their taxes using. There are plenty of things you can subtract from your gross income to give you a lower taxable income. For most people, within this game is to locate and use as they're as possible, so you could minimize your tax disclosure.

Using these numbers, is actually not unrealistic to positioned the annual increase of outlays at typical of 3%, but number of simple is removed from that. For that argument that this is unrealistic, I submit the argument that the normal American to be able to live with the real world factors within the CPU-I and in addition it is not asking a lot of that our government, as well as funded by us, to measure within those self same numbers.

Tax evasion can be a crime. However, in such cases mentioned above, it's simply unfair to an ex-wife. Attain that in this particular case, evading paying for an ex-husband's due is only one fair bargain. This ex-wife is not stepped on by this scheming ex-husband. A tax debt relief can be a way for your aggrieved ex-wife to somehow evade from just a tax debt caused an ex-husband.